The Indian stock market has always been a kaleidoscope of opportunities and risks, with different segments showing varying degrees of performance. I came across a tweet by TradingView, which shows a chart depicting the trajectory of Smallcap, Midcap, and Nifty indices paints a telling picture: Smallcap stocks have soared with an impressive gain of over 57%, outshining their Midcap and Nifty counterparts.

Why Profit Booking in Smallcap Makes Sense

Smallcaps have been the darlings of the NSE in the recent past, rewarding investors with substantial returns. However, the sheer pace of this growth warrants a strategic pause and reflection. It’s an age-old wisdom in investing to “sell high and buy low,” and this is where profit booking comes into play. By skimming some gains off the top of your Smallcap investments, you’re not just securing profits but also protecting your portfolio from potential volatility that often comes with overheated segments.

The Case for Largecap Stocks

On the other end of the spectrum, we have the Nifty index, which is primarily reflective of the large-cap stocks. With a more modest increase of around 19%, it suggests that there might be untapped potential waiting to be realized. Largecap stocks generally represent well-established companies with stable earnings, often making them less susceptible to the abrupt price swings seen in smaller companies.

Strategic Reallocation: A Two-Month Window

The strategy I propose is a calculated reallocation: taking profits from the Smallcap sector and reinvesting them into the large-cap stocks. This isn’t just a haphazard shift but a targeted move to capitalize on the underperformance of large-cap stocks which may be poised for a rebound. A one to two-month window is suggested for this tactical move, providing enough flexibility to navigate short-term market fluctuations while setting the stage for potential gains from a large-cap rally.

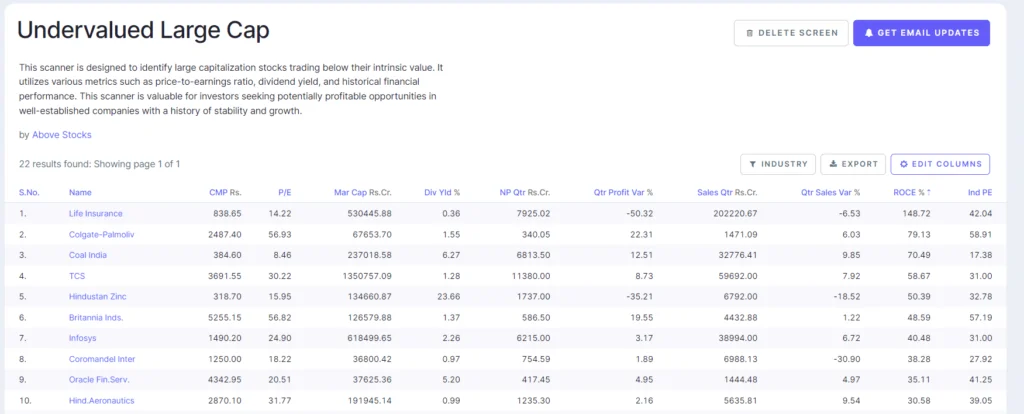

I have designed a screener about “Undervalued Large Cap”, which can be used to identify large capitalization stocks trading below their intrinsic value. It utilizes various metrics such as price-to-earnings ratio, dividend yield, and historical financial performance. This scanner is valuable for investors seeking potentially profitable opportunities in well-established companies with a history of stability and growth.

Final Thoughts

Investing is as much an art as it is a science. While the chart and numbers provide a compelling argument, they are merely a part of the complex decision-making process. An investor’s journey is unique, and so should be their investment strategy. This shift from Smallcap to Largecap is rooted in the principle of rebalancing, a fundamental practice to ensure that your investments align with your financial goals and risk appetite.

Remember, the markets are dynamic, and strategies should be fluid. Stay informed, stay agile, and let your portfolio reflect not just the market’s present, but also its potential future.